GPT overview

- GPT Category: Text LLM

- Creator type: Community

- GPT name: Finance Bill GPT

- Created by: Kelvin Onkund

Finance Bill GPT overview

Finance Bill GPT is a specialized AI chatbot created by Kelvin Onkundi to help Kenyans understand the complex details of the 2024 Finance Bill.

This tool leverages OpenAI’s powerful language models, including GPT-4, to provide clear and accurate information about the bill’s provisions, implications, and potential impacts.

About Kenya’s Finance Bill 2024

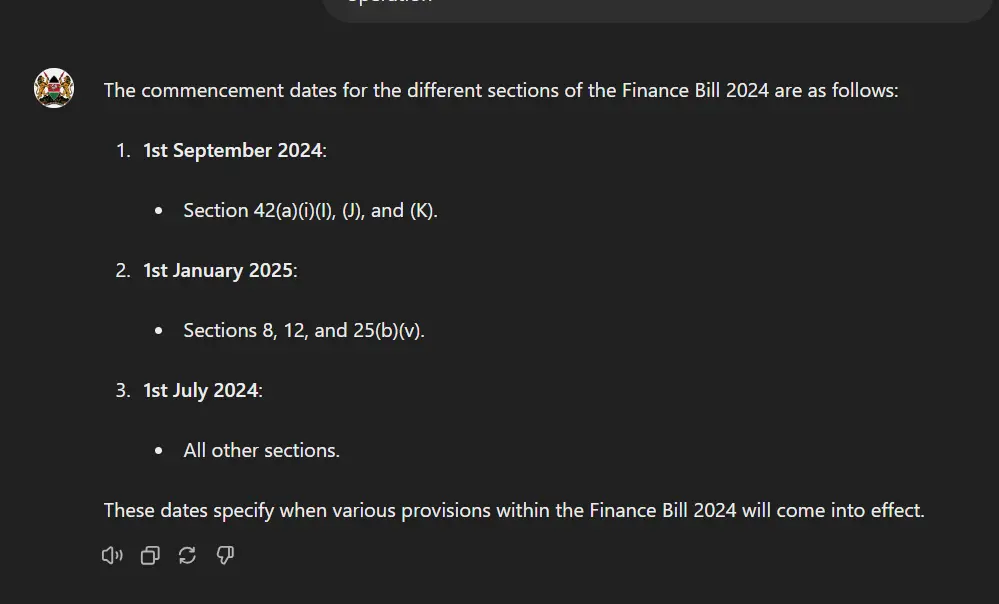

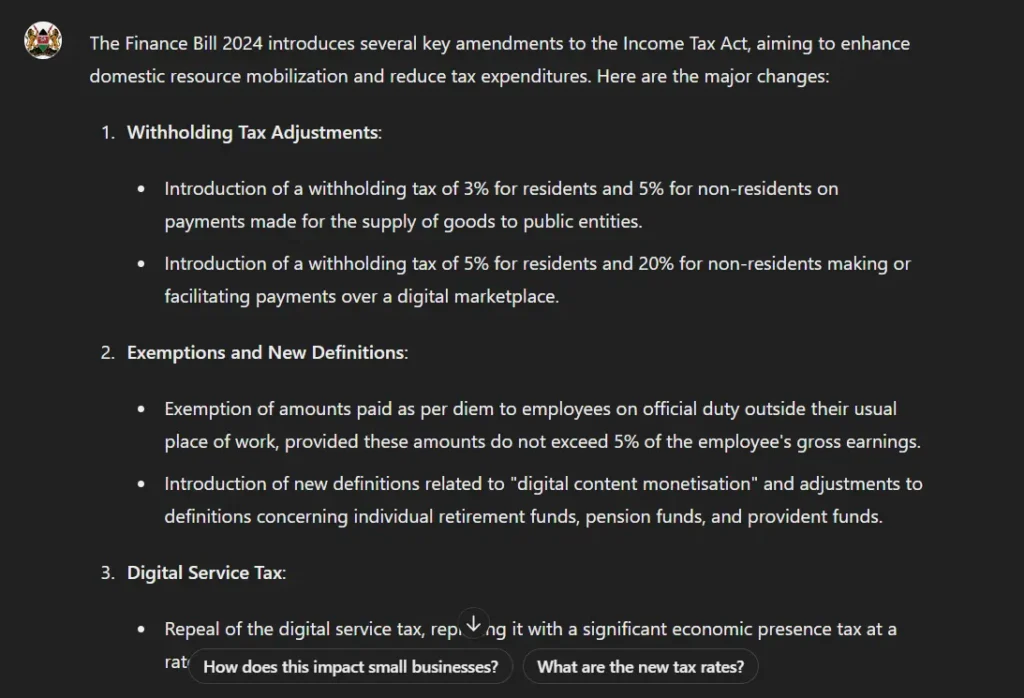

The Finance Bill 2024 proposes amendments to several key pieces of legislation, including the Income Tax Act, Value Added Tax Act, Excise Duty Act, and more.

It aims to raise an additional Ksh. 300 billion through new taxes and levies including motor vehicle tax, a move that has sparked significant public debate and opposition.

The Finance GPT

Kelvin Onkundi’s Finance Bill GPT is designed to answer questions about specific aspects of the bill, helping users understand how the changes might affect their finances and daily lives.

The chatbot’s development involved training on the bill itself and related journalistic articles, ensuring it provides up-to-date and relevant information.

Key functionalities of Finance Bill GPT:

- Detailed explanations: Breaks down complex legislative language into easy-to-understand summaries.

- Impact analysis: Offers insights into how the proposed changes will affect different sectors and individuals.

- User interaction: Allows users to ask specific questions and receive tailored responses about the bill.

Example prompt

AI Prompt: Help me calculate my net salary based on Finance Bill 2024

Result:

To calculate your net salary based on the Finance Bill 2024, we need to consider the changes introduced in the bill. Here are the key aspects that impact individual income tax:

- Tax Bands and Rates: Verify if there are any changes to the tax bands and rates.

- Allowances and Deductions: Check for any changes in allowances and deductions.

- Other Taxes: Include any additional taxes that may impact net salary.

Key Changes in the Finance Bill 2024

Based on the Finance Bill 2024 document:

- Tax Bands and Rates: The bill mentions adjustments in tax brackets and rates.

- Allowances:

- Subsistence, travel, entertainment, or other allowances not exceeding 5% of the monthly gross earnings are exempt.

- The maximum limit for various deductions and exemptions has been increased (e.g., from KSh 240,000 to KSh 360,000).

Here is a hypothetical example to illustrate the calculation based on a gross monthly salary of KSh 100,000:

Income Tax Rates

The following income tax rates will be applied:

- 10% for income up to KSh 24,000 per month.

- 15% for income between KSh 24,001 and KSh 32,333 per month.

- 20% for income between KSh 32,334 and KSh 48,000 per month.

- 25% for income between KSh 48,001 and KSh 64,000 per month.

- 30% for income above KSh 64,000 per month.

Allowances

- Personal relief: KSh 28,800 annually (KSh 2,400 monthly).

- Insurance relief and other deductions as per updated limits.

Calculation

- Calculate Taxable Income:

Gross Salary: KSh 100,000

Less: Allowances (5% of gross salary): KSh 5,000

Taxable Income: KSh 95,000- Apply Tax Rates:

- First KSh 24,000 at 10%: KSh 2,400

- Next KSh 8,333 at 15%: KSh 1,250

- Next KSh 15,667 at 20%: KSh 3,133

- Next KSh 16,000 at 25%: KSh 4,000

- Remaining KSh 31,000 at 30%: KSh 9,300 Total Tax: KSh 20,083

- Apply Personal Relief:

Personal Relief: KSh 2,400

Tax After Relief: KSh 20,083 – KSh 2,400 = KSh 17,683- Net Salary:

Net Salary: Gross Salary – Tax After Relief

Net Salary: KSh 100,000 – KSh 17,683 = KSh 82,317This is a simplified example, and the actual calculation might vary based on additional deductions, specific allowances, or other personal tax reliefs.

…

Finance Bill GPT offers a valuable resource for anyone seeking to understand the financial and legislative landscape in Kenya.

By breaking down complex information and providing accessible explanations, it helps users stay informed and engaged with the country’s fiscal policies.

Finance Bill GPT functionalities

Finance Bill GPT FAQs

What is the purpose of the Finance Bill 2024?

The bill aims to amend various tax laws to increase revenue for the government, with a target of raising Ksh. 300 billion through new taxes.

Who created the Finance Bill GPT?

The tool was created by Kelvin Onkundi, a software engineer from Kenya.

How can I access Finance Bill GPT?

You can access it through the provided link and sign up to chat with the GPT for detailed information on the bill.

What are some key changes proposed in the bill?

The bill includes new taxes on motor vehicles, increased VAT, and amendments to the Income Tax Act, among other changes.